Having lived in Spain for a little over 2 years, opening an autonomous business was a logical step towards legalizing your business. Of course, there is an opinion that if you pay taxes here, you have a chance to legalize yourself in the future (but these are just opinions). Also, being able to show income in Spain will be a big plus when looking to rent an apartment, buy a car on credit, or get a mortgage. And I think paying taxes in the country you have been living in for a long time is right in any case.

This will be a long article with real examples and my own experience. I hope that this entry will eventually become a section on our website. Ukrainians.uno with all the necessary and important information, tips, life hacks and instructions for working as an autonomo (self-employed person) in Spain.

Join our Telegram channel to always stay up to date with new articles and useful materials about life in Spain. https://t.me/ucranianos_uno

And I invite you to chat – https://t.me/ucranianos_uno_chat. There we will discuss topics from articles and share experiences. Also, in the future, separate branches will be created for the convenience of discussion: autonomous, medicine, mortgage, customs clearance and others.

0. The beginning, a little about me

I'm thinking about where to start. Maybe a good solution would be to tell a little about myself and the activities I do. I'm a web developer and have been working freelance for many years, so to speak "for myself". I've never worked for any company and have not received a fixed salary. I had an individual entrepreneur (group 3) in Ukraine. Most of my clients are Ukrainians (I think it will be interesting to find out how I now accept payments from Ukrainians to a Spanish account), also many clients are from the Czech Republic, Germany, Slovakia and other EU countries, Ireland, Britain, etc. I already have clients in Spain. Why do I mention this? Because invoices and the notorious VAT (better known as IVA 21%) that we, as tax residents of Spain, have to indicate in our invoices and return these funds to Spain will be slightly different for different countries.

After making the decision to register as an autonomous entity in Spain, the question arose - what to do with an individual entrepreneur in Ukraine? This is where the long and laborious search for information, consultations, and reading a bunch of correspondence in chats to understand what is best begins. But in almost all cases, it all came down to one thing - you need to consult with a hestor. A hestor in Spain is like an "accountant in Ukraine" and a person who understands all these nuances, manages your activities and submits reports for you in Spain. I will tell you later whether it is possible to do without this, but at this stage I was interested in something else - to get advice and information from a hestor about what to do with an individual entrepreneur in Ukraine, how and when it is better to register an autonomous entity, etc. I received the consultation (by the way, from a Ukrainian-speaking hestor, which greatly simplified everything) and the following was decided:

- It is better to close a sole proprietorship in Ukraine before starting work as an autonomous person in Spain, so as to avoid confusion with taxes in the future;

- It is better to register as an autonomous person in Spain "from scratch" for the following year after closing the sole proprietorship (this is not mandatory, but I started dealing with these issues at the end of the year and it was logically better to wait until the beginning of next year)

Why is that? In order not to report to Spain for the year when I was still working as an individual entrepreneur, not to mix income and reporting from two different countries. The issues are actually very controversial, but this is my experience. Although, by the way, I already filed a tax return in Spain on my own initiative for the year when I was still working as an individual entrepreneur in Ukraine, and even paid tax on that income. I have heard a lot that this is not possible, but the answer is “yes, it is possible”. I will probably talk about this in a separate article later.

Well, let's get to the first point - preparing for autonomous registration.

1. Preparation for registration, choosing a host

First of all, it is important to decide whether you will conduct your business with a tax agent in Spain or not. The option "no" is also possible and automated systems (something like Taxer in Ukraine) such as TaxScouts, InfoAutonomos, Xolo, Declarando, Gestoria.online and many others. Of all these, the most normal service seemed to me TaxScouts. Everything is available and clearly shown there, the price is reasonable and there are very convenient tax calculation tools, useful blog articles, etc. You can go to with this TaxScouts referral link and you will receive a 10% discount for the first 3 months, and in turn I will receive some kind of bonus.

The average monthly price for a normal package (which includes support for working with foreign clients, etc.) on these services will be almost the same as The price of Hestor maintenance is approximately 80 euros/month. (including VAT). Perhaps, if your activity does not require issuing a large number of invoices (in different countries) and other complex operations, then you can choose one of these existing automated systems for autonomous management. But I am still for the option when there is an opportunity to communicate, ask and resolve any issues, and in Ukrainian (when the hestor is Ukrainian-speaking).

Platforms simplify the process and save time, but hestors provide more individual support, which can be useful for more complex situations. I have friends who work with Spanish-speaking hestors and are also very satisfied. There are those who are not satisfied and have switched to another hestor, it is not difficult to do this. There are many companies that help run a business in Spain, here they are also called Asesoria or Hestoria. But, as a rule, it is difficult to find someone decent, and it is better to look for recommendations.

To get the contact information of my Ukrainian-speaking hestor, whom I can safely recommend, and to learn more about all this, go to the article Hestor for autónomo in Spain: what it does and why it is needed. There is a contact form at the bottom, after submitting which you will be contacted by the seller.

2. Opening a bank account

It is clear that for official work in Spain you will need to have a bank account here.

In Spain, you can receive payment in any convenient way, such as:

- PayPal (referral link) a convenient and I think well-known service that makes it easy to accept payments from customers who also have PayPal, you can easily pay in Spanish online stores, transfer funds anywhere;

- Wise (referral link) you can accept payment in any currency, order a physical card, a very convenient application, they charge up to 4% per annum on the balance of funds in the account;

- other online banks or payment acceptance systems (Revolut, Stripe, etc.);

- even in cash (it all depends on the type of your business, although there are certain limits here).

But I think you still can't do without a Spanish account. It is from it that your taxes (IRPF), social security contributions, etc. will be deducted in the future, and believe me - it is better if it is a Spanish account in a normal bank so that there are no problems with these payments. The Spanish tax website even has list of recommended banks for this (Entidades adheridas al pago de autoliquidaciones con cargo en cuenta).

At the time of opening the autonomous, I already had an account with Santander Bank and, as it turned out, there is no need to open a separate account or any special account for the autonomous. You can easily accept payments to your own account. But it is still recommended to separate your own funds from the business funds and open a separate account (there are many different offers specifically for autonomous), or even better in some other bank. There are several reasons for this:

- If any of your accounts are blocked (which is possible in Spain), you will not be left without funds;

- With a separate account, it will be easier to keep records in the future;

- In the event of a tax audit, it will be easier to see and show income, expenses, etc.

From the very beginning, I accepted payments to my own account at Santander, but later I still listened to the advice and opened a separate account for autonomous (for business). I went to different banks and found out about their conditions. They offer a lot of different things. I liked CaixaBank the most of all. I think, like in all other normal banks, for this business account you pay €0/month if you meet certain requirements. I don't remember them all exactly, but one of the conditions is to receive income on this account, pay taxes from it, social security (social contributions), etc. You need to ask for more details when opening it so that there are no misunderstandings later. I really like Santander Bank and there is no monthly fee there at all. We opened the account at the beginning of 2022 and then it was very simple for Ukrainians and all you had to do was have a foreign passport. Now I think the situation has changed.

3. Digital signature

For convenience and easy access to most online services of official institutions in Spain (for example, tax), you cannot do without a digital signature. It is done very simply and then you install this signature (file) on your computer. After the signature is installed on your computer, when you go to these services, your browser will already see that it is there and will offer to log in or use it for the desired action (signing a document, etc.). I think that for registration and maintaining an autonomous system, having a valid digital signature is necessary.

I used to sign my name when we lived in the south of Spain in the city of Elche. There is a wonderful institution at the city hall (ayutamento) called OMAC. It reminded me of our Ukrainian service center where you could get various government services in a matter of minutes.

How and where to make a digital signature if you don't have one, I think you can find out at the town hall (Ayuntamiento) of your city. And remember – this is a free service if done at a government institution. Other institutions or online services charge money for these signatures. It is better to clarify this by location.

I will later write a separate article on this where I will explain all the intricacies of opening and working with a digital signature so that it is clear to everyone.

4. Autonomo registration in Spain

I don't even know what to write here because the registration process is very fast and is usually handled by your accountant or the service you choose to manage autonomously. You won't need to run to any institutions and take out a net. Everything is done online.

What do you need to have to register as an autonomous in Spain?

For autonomo registration it is necessary to have valid Spanish documents, namely:

- NIE (white paper) with the right to work or TIE (plastic card);

- social security number fear (número de la Seguridad Social);

- address in Spain or even better registration (empadronamiento);

- the phone number is Spanish (I don't think that any other number will be allowed in official institutions).

For those who do not have a number and are not registered with the social security system, you will need to go to your local Seguridad Social office to register there or ask a hestor to do it online (registers in a few minutes if you have a digital signature). Many people were assigned this number when they received their NIE, but recently they do not do this and you have to go through this procedure yourself.

Well, the main thing is to understand what you will be doing (type of activity) in order to choose something like KVEDIs as it was in Ukraine. Hestor did it all for me after I described the type of activity, what I work with and what services I will provide. If it's very simple, then a special code is selected that corresponds to your field of activity. This code determines the tax rate on economic activity (IAE) and is tied to the classification of economic activities (CNAE), which is used in Spain:

- IAE (Economic Activities Tax): This is a tax that depends on your activity, but most autonomous communities are exempt from it if their income is less than 1 million euros per year.

- CNAE (National Classification of Economic Activities): This is a classification system that helps tax authorities understand what exactly you do.

To avoid any confusion here, it's better to entrust this to a hat store that will help you choose the appropriate code depending on your job description.

Registration of an autonomous entity takes a short time (approximately 1-3 days) and after registration you will receive some documents that will confirm that you can already start conducting economic activities in Spain:

- Model 036 or 037: This is a document from the tax office (Hacienda) that confirms your registration as an autonomous. It contains: your personal details, IAE code (type of your activity), tax obligations (for example, whether you need to file IVA declarations).

- Alta en el Regimen Especial de Trabajadores Autónomos (RETA): This is a confirmation from Social Security (Seguridad Social) that shows you are registered to pay contributions.

It is also important to obtain an EU VAT number if you will be working with clients outside Spain. The EU VAT (NIF-IVA) is required for working with clients in other EU countries. It allows you to carry out international transactions without charging VAT thanks to the “reverse charge” mechanism, which I will mention later. To obtain this number, you need to apply via form 036/037 to the tax office (Agencia Tributaria) and register with the ROI (Registro de Operadores Intracomunitarios). My accountant submitted all this for me and I simply received confirmation by email later that I had already received this number and it was entered into the database. This number will also be entered into the VIES system so that other companies can check it. This is a mandatory step for those who plan to work with EU countries. The VAT number looks like the NIE number but with the prefix ES at the beginning, like ESY*******G. This number must be indicated on invoices for EU clients outside Spain.

5. Monthly contributions and social security

Immediately after opening, you will autonomously start paying social contributions (Seguridad Social). Monthly social contributions are something like the Social Security in Ukraine. They are mandatory and provide access to various social services in Spain, state medicine and play an important role for future pension in Spain.

As I already wrote, social contributions are mandatory. You can earn 0 euros per month, but the social contribution for this period will still be automatically debited from your account on the last working day of the month. And here it is very important to understand that this amount must be in your account on that day because for untimely payment of social. contribution you will later pay a fine and there will be troubles.

Discount for the first year of social security contributions (tarifa plana)

The first year after opening an autonomous company, a discount is provided and the amount of social contribution is 86.66 euros per month (since 2025 this has already been changed) 87.60 euros per month). Immediately after opening the autonomo, this payment will be debited from the account at the end of the month (or at the end of the following month if the registration was after the 15th) and will be proportional to the number of days from the date of opening the autonomo. For example, my autonomo was opened on January 8 and for this month I was debited 69.33 euros and for all subsequent months – 86.66 euros.

It is important to monitor the account balance at the time of debiting (end of the month) Social Security contributions. If there are insufficient funds, the preferential tariff (tarifa plana) will be canceled and the contribution will be charged at the standard rate without discounts and you will also have to pay penalty interest, which will depend on the period of debt. Therefore, it is better to always check whether there is sufficient amount in your account before the day of debiting.

The preferential tariff/discount (tarifa plana) for autonomous workers is valid for the first year after registration. However, it can be extended for another year provided that your average net monthly income in the second year does not exceed the subsistence minimum (in 2025 this is around €1,260). If your income exceeds this limit, Seguridad Social will automatically recalculate your contributions and you will have to pay the difference between the preferential rate and the standard rate. To extend the tarifa plana, you must apply to Seguridad Social in advance, approximately one month before the end of the first year of the tariff. You can do this yourself through the Seguridad Social portal or, better, through a hestor.

In the future, social contributions will depend on your income and, to be honest, they are quite large. For example, if you earn 1,166-1,300 euros per month, you will pay 291.60 euros in social contributions. You can read more about this and get acquainted with it on the website https://portal.seg-social.gob.es/. There you can also enter your personal account (Entrar en tu área personal) Seguridad Social, see your autonomous data, registration date, Vido Laboral, the amount of your contributions and there is also a section “Simulate quota for income” where you can see the amount of contributions depending on income. Entering this account is very easy using an Electronic Certificate or Clave.

Income is divided into ranges (trams), and for each of them the minimum and maximum contribution bases are defined. We choose any base within the income limits Tramo and the contribution that will need to be paid is 30,6% from the selected base. For example, for income from 1166.70 to 1300 euros the minimum contribution will be 291 euros, and the maximum is 397 eurosFor an even more illustrative example, I will attach a table showing what the minimum Seguridad Social contribution will be depending on the average monthly income during the year:

Table of income and minimum contributions to Seguridad Social in 2025

| Tramos (income) | Min. contribution base in 2025 (€) | Contribution 2025 (€) |

|---|---|---|

| up to €670 | 653,59 | 200 |

| between 670 and 900 € | 718,95 | 220 |

| between 900 and 1,166.70 € | 849,67 | 260 |

| between 1,166.70 and 1,300 € | 950,98 | 291 |

| between 1,300 and 1,500 € | 960,78 | 294 |

| between 1,500 and 1,700 € | 960,78 | 294 |

| between 1,700 and 1,850 € | 1143,79 | 350 |

| between 1,850 and 2,030 € | 1209,15 | 370 |

| between 2,030 and 2,330 € | 1274,51 | 390 |

| between 2,330 and 2,760 € | 1356,21 | 415 |

| between 2,760 and 3,190 € | 1437,91 | 440 |

| between 3,190 and 3,620 € | 1519,61 | 465 |

| between 3,620 and 4,050 € | 1601,31 | 490 |

| between 4,050 and 6,000 € | 1732,03 | 530 |

| €6,000 and more | 1928,1 | 590 |

If, at the end of the year, it turns out that your actual income was lower or higher than the income corresponding to your Tramo, Seguridad Social will make an adjustment:

- If the income was smallerthan the chosen Tramo, you may return the overpayment;

- If the income was higherthan allowed by your Tramo, you will have to pay the difference.

This is done automatically after submitting the annual income tax return (Personal income tax), when tax authorities transmit this data to Social Security.

Access to free healthcare and social security in Spain

It is important to understand that social contributions provide you and your entire family with access to free healthcare and social insurance. I wrote more about this in the article about SIP in Spain.

6. First invoice and receipt of payment from the client

After registration and all the previous steps, it was time to "write out the first invoice." For me, it was a client from the Czech Republic. I asked for help from the hestor and looked online for examples of invoices for Spain so as not to confuse anything and do it right. In fact, everything turned out to be very simple, but there are certain rules that must be followed when conducting business and issuing invoices:

- all invoices should be logically numbered like 0001, 0002 … or there may be a different style but the logic of the numbering should not be violated. I chose the option like 01/2024, 02/2024, etc.;

- It is important that the invoice date is indicated in the invoice and it is on this date that the invoice will be related to a certain reporting period. There may be a case when we issued an invoice at the end of the 4th quarter (for example, December 30) and the client sent the payment as early as January 5. This is not a problem and this income will be attributed to the 4th quarter when the invoice was issued. The problem may be if, on the contrary, you receive payment and the invoice date for this payment is indicated much later.

- the invoice must include your full details, the address at which the autonomous is registered, NIE or VAT number if the invoice is for another EU country, and contacts;

- the client's data must be specified (there are differences depending on the client's country of residence and I will describe this in more detail below);

- of course, the name of the service provided and the price for this service must be indicated;

- Information about the type of payment is also indicated (this can be PayPal, Wise, Revolut, payment to a bank account, etc.). More often, I have bank account details and the payment type "bank transfer";

- I also indicate on each invoice a note about the purpose of the payment where I write something like "payment according to invoice 01/2024";

- On invoices for countries outside Spain, I also provide additional information about VAT/IVA (the “reverse charge” mechanism). I will explain this in more detail below.

I will attach an example of an invoice that I use myself. I created it in Excel, set up some automation (some fields are filled in automatically). You can download it, change the data in the template and use it for your business.

What customer data should be included in invoices?

1. For an individual (provided a service to an ordinary person, not an entrepreneur or company):

- Required: client's first and last name.

- If the client is in Spain: it is advisable to provide the address and NIE if the client provides these details (although the NIE is not mandatory).

- If it is a regular individual from another country, a first name, last name, and address (if possible) is sufficient.

2. For a company (provided a service for a company or entrepreneur):

- Required: company name (or entrepreneur details) and tax address.

- If the company is in Spain: NIF number (or CIF for legal entities).

- If the company is from another EU country: VAT number (the abbreviation may vary in different countries). If the company is not registered for VAT (is not a VAT/IVA payer), indicate other available tax details.

What IVA / VAT should be indicated on invoices in Spain?

The IVA rate in invoices in Spain depends on the type of service. Most often it is 21% (standard rate). For example, if we provide a service for a client in Spain and the price of this service is 1000 euros, then in the invoice we indicate 1000 euros + IVA 21% and the amount of payment for the client will already be 1210 euros. These 210 euros that the client pays, you are obliged to transfer to the tax office (Agencia Tributaria) when submitting the quarterly declaration with IVA, but minus the VAT you paid for the costs of conducting business. For example, if you bought a laptop for 1000 euros, where the IVA is 21% (the same 210 euros), then this amount will be deducted from the total amount of IVA that we need to pay. Now again a very simple example to understand this better:

- We issued only one invoice for 1,000 euros per month.

- In the invoice, we indicated IVA 21%, which is 210 euros, meaning the total amount the client pays us is 1210 euros.

- During the same month, we bought a laptop for work for 1210 euros, where the price includes IVA and it is 21% (210 euros).

- When submitting your quarterly IVA return, we take into account:

- +210 euros IVA received from the client.

- -210 euros of IVA paid when purchasing the laptop.

- As a result: 210 (IVA received) – 210 (IVA paid) = 0 euros, that is, we do not pay IVA to the tax office for this month, and the price of the laptop at this stage for us is not 1210 euros but 1000 euros.

By the way, IVA is also deducted from services that we pay for to run our business, for example, IVA from paying for a store, services for work, etc.

The “reverse charge” mechanism or IVA 0% when working with EU countries

For clients from EU countries, if it is a company registered as a VAT payer, IVA 0% is usually indicated using the reverse charge mechanism (it is better to write an additional note about this on the invoice, I will show you which one in the examples). I always clarify with clients whether they are VAT payers in order to understand what to indicate on the invoice. And there are cases when, for example, the company is not a VAT payer (this is the case in many countries, including the Czech Republic, with which I often work) and then I add IVA 21% to the invoice. Some clients understand this, but some do not really want to overpay. Here everything needs to be decided in advance so that there are no unnecessary questions later.

IVA / VAT is one of the most complex taxes and has a lot of nuances that depend on the type of activity, the client and the place of provision of services. For a correct understanding and filling in of invoices, it is better to consult your accountant. More details about IVA, what I added and paid during the year can be seen in the section “Real examples of income and taxes for the year of autonomous in Spain”.

In what language should invoices be created?

Ideally, invoices should be in Spanish, but of course they can be in English, for the tax office this is not critical. For example, in my invoice template I wrote everything in Spanish but with English comments. This is convenient for me and for clients from other countries.

What currency should be indicated on invoices?

As we know, the official currency of Spain is the euro and of course all reporting and income will be in EUR anyway. But you can also indicate another currency in the accounts, for example the American dollar USD. The only thing you need to understand is that this amount will be converted at the exchange rate from USD to EUR when submitting the report.

I always try to specify only EUR, and then the client in his country pays in his currency at the bank with conversion to EUR. This way I get EUR and there is no need to convert at the exchange rate.

There is another example when a client from the USA sends me a payment to my PayPal, the main currency of which is the euro. And it is very convenient that PayPal immediately converts it to EUR and I then indicate this amount in the invoice.

Accepting payments from Ukrainians to a Spanish account in euros

Many of my clients are in Ukraine, but due to the restrictions imposed during martial law in our country, sending currency abroad (SWIFT payment to IBAN) is currently impossible. I found a solution for myself - to accept payments through the Stripe worm. It is something like an acquiring system for accepting payments like WayForPay or LiqPay, which are available in Ukraine. Stripe is one of the most popular services in Europe for such operations. After registering, checking all the data (bank account, autonomous documents), it becomes possible to issue an invoice in euros, and the client pays for it in any convenient way online (ApplePay, GooglePay, VISA\Mastercard card, etc.).

- I enter the client's individual entrepreneur data for the invoice (bill) in Stripe

- I am entering the service details and the price in euros.

- I generate a payment link and send it to the client.

- After successful payment, I create a separate account for Autonomo for the amount received including the Stripe fee (approximately 3%).

By the way, Ukraine is outside the IVA tax area, so my bills indicate 0 euros VAT.. But there is a nuance here – 0 euros if we provide a service for an individual entrepreneur, not an ordinary individual. That is why I always asked for the individual entrepreneur's details from the client, which I later indicated in my invoice.

This may not be the most convenient way, but it's the one I have so far. Share in the comments if there is another simpler or more convenient option.

What are these invoices for in Spain and do they need to be kept?

We create invoices primarily for ourselves and for tax reporting, as they confirm our income and allow us to calculate taxes. Often, the client may not need this invoice, for example, if it is an individual who does not use it for tax purposes. However, for us it is a mandatory document, because it is on the basis of these invoices that we report to the tax authorities and calculate the tax to be paid or refunded. And remember that all documents must be kept for at least 5 years, as the Spanish tax authorities may request information about any operation during this period.

7. IRPF tax or income tax in Spain

IRPF (Impuesto sobre la Renta de las Personas Físicas) is a personal income tax that is paid by all tax residents of Spain. For autonomo, this tax is one of the key ones, because it is calculated based on your net income, that is, the difference between income received and expenses that you can write off. I will write about expenses and what they may be in more detail later, but now I want to clarify that we pay IRPF tax on all income (they also say on world income) that we received during the reporting period. It is important to understand that from the moment Autonomo was opened, we are already considered a tax resident of Spain on 100% and for this year we definitely have to pay tax on all income received, whether in Spain or outside Spain, whether we rented an apartment somewhere in Ukraine, etc. Of course, you need to be very careful here and it is better to consult with a tax specialist who will help you figure this out.

What do you need to know about IRPF?

1. Progressive taxation system:

The IRPF tax we pay depends on the amount of income. The more you earn, the higher the tax rate. In general, the rates range from 19% to 47% depending on your annual income. But many people are confused and horrified by this figure of 47%. It's not really that bad. A progressive scale means that different parts of your income are taxed at different rates, rather than all of your income being taxed at the highest rate.

Progressive IRPF scale in 2025:

A scale is used to calculate IRPF, which depends on annual income. The approximate rates are as follows:

- Up to €12,450 – 19%

- From €12,451 to €20,200 – 24%

- From €20,201 to €35,200 – 30%

- From €35,201 to €60,000 – 37%

- Over €60,000 – 47%

That is, the maximum rate 47% applies only to the part of the income exceeding €60,000, and not to the entire amount.

As an example, I will calculate how much tax you will need to pay for 30,000 euros of net annual income based on this scale:

- First €12,450 of income: €12,450 × 19% = €2,365.50

- Income from €12,451 to €20,200: (€20,200 – €12,450) × 24% = €1,860

- Income from €20,201 to €30,000 (€30,000 – €20,200) × 30% = €2,940

The total tax that will be paid on 30,000 euros is 2365.50 € + 1860 € + 2940 € = 7 165,50 €.

The real tax rate is €7,165.50 ÷ €30,000 × 100 = 23,88%.

Importantly, the actual tax rate may be even lower because when you file your annual tax return (declaración de la renta), you are entitled to discounts and deduction.

During the year, we pay IRPF advance payments in the amount of 20% from net income each quarter, and when submitting the annual declaration, the recalculation takes place. As a result:

- If the amount of advance payments exceeds the actual tax charged, you receive refund from the tax office.

- If the opposite is true, you will need to pay extra the difference.

The next paragraph will discuss this in more detail.

8. Tax reporting and declarations

Quarterly declarations:

1. Quarterly IRPF payments (modelo 130):

Autonomous are obliged to pay advance payments of IRPF every quarter. This declaration indicates 20% of net income for the period. This is always done by the accountant (or some automated service that I already wrote about). We just have to send all our income and expense accounts on time and then we receive the amount that will be automatically debited from the account for that reporting quarter.

Submission deadlines:

- 1st quarter: until April 20.

- 2nd quarter: until July 20.

- 3rd quarter: until October 20.

- 4th quarter: until January 30 of the following year.

2. Quarterly VAT declaration (modelo 303)

This is a quarterly declaration to record the IVA collected and paid.

- Who files: all self-employed persons who are IVA payers.

- What is taken into account:

- IVA collected (from invoices issued to customers).

- Paid IVA (on invoices for services received or goods purchased for your work).

- The difference between them is paid or reimbursed.

Submission deadlines:

- 1st quarter: until April 20.

- 2nd quarter: until July 20.

- 3rd quarter: until October 20.

- 4th quarter: until January 30 of the following year.

Annual declarations:

3. Annual VAT declaration (form 390)

This is a summary declaration that includes all IVA information for the year.

- Submitted: by January 30 of the following year.

- Who submits: autonomously, who submitted modelo 303.

- What counts: the total amounts of IVA collected and paid for the year.

4. Annual income tax return:

I think you can also write here "the most important declaration in Spain".

During the period from April to June In Spain, a general declaration is filed, which includes all income for the previous year. And as a rule, it is filed not only for autonomous communities, but also for individuals (tax residents).

If we paid more than we should, the state will refund the overpayment, if less, we will have to pay more. For example, we paid advance IRPF contributions during the year (20% of net income for each quarter), but at the end it turned out that our annual net income did not exceed 12,000 eurosIn this case, Spain will refund all advance payments, as this income does not exceed the minimum that is not taxed in Spain (this is 15 947 € for 2025).

In addition, the annual declaration takes into account many other important individual aspects, such as:

- Presence of children: You can get additional benefits for each child.

- Marital status: If your spouse is unemployed, or if you have dependents (such as elderly parents), this can also help reduce your tax burden.

- Mortgage or rental housing: If you pay a mortgage or rent a home, a portion of these expenses may be deductible for tax purposes.

- Additional costs: Expenses for charity, education, or retirement plans also count towards reducing your tax base.

It is always very important to fill out the declaration correctly in order to return not only part, but possibly all advance payments, or to receive additional benefits. As a result, all this allows you to optimize taxes in Spain and here everything does not look as scary as those 47% that are often talked about. It is also important that the taxman receives from you all the necessary information for submitting the annual declaration.

Other important declarations in Spain:

- Modelo 349 (reports on transactions with the EU):

- The presentation depends on the number of transactions: monthly, quarterly or annually.

- Deadline: by the 20th of the month following the reporting period.

- Modelo 115 (rental):

- If you rent an office or space, you must pay withholding (retención) on the rent.

- Submission deadlines: quarterly (by the 20th of April, July, October, January).

- Modelo 347 (informative declaration of transactions over 3,005.06 euros):

- Includes transactions with customers or suppliers that exceed this amount per year.

- Submission deadline: February 28 of the following year.

- Modelo 111 (withholding from wages or services of freelancers):

- If you have employees or hire other professionals.

- Submission deadline: quarterly.

10. Costs for self-employment in Spain (what is possible, what is not recommended)

As an independent, you have the right to deduct certain expenses related to your professional activity. This will optimize your tax burden (your IRPF tax will be lower) because we only pay taxes on net income after deducting expenses. Here are the main categories of expenses that can be taken into account:

- Professional equipment and materials: laptops, phones, printers, software.

- Hestor services: mandatory component for tax reporting.

- Office or coworking space rental: if you work outside the home.

- Health insurance: can independently write off the costs of private insurance as expenses for themselves and their family (up to certain limits, usually a maximum of 500 euros per person per year).

Before writing off any expenses, you should think carefully about whether they correspond to your business and are permissible. For example, writing off personal expenses for travel or restaurant bills that are not related to work may raise questions from the tax office.

Professional equipment costs

Deducting equipment costs (laptops, phones, printers, etc.) is an important part of tax optimization for the self-employed. Expenses can be written off both through IVA refunds and by reducing the IRPF tax base (i.e. expenses are deducted from income).

IVA refund

If the equipment is subject to IVA, we can deduct this from the total IVA when submitting the quarterly declaration (modelo 303). This is indicated as “IVA soportado” (IVA paid). This will reduce the total amount of IVA that we will pay to the state.

Write-off from IRPF tax

If the equipment is used not only for work but also for personal needs (for example, a phone or laptop), the costs are only written off in proportion to the work use. For example, if the phone is used on 70% for work, only 70% of its cost can be written off. Also, if the equipment costs more than 300 euros, its cost may not be written off immediately, but rather by amortization over several years. For example, a laptop may be depreciated over 4 years, with 25% of its cost written off annually.

Example of writing off equipment costs

We bought a laptop for 1,210 euros (of which 210 euros is IVA).

- You immediately write off 210 euros of IVA in the quarterly Modelo 303 declaration.

- 1000 euros (excluding IVA) is spread over 4 years: 250 euros is written off as expenses each year.

What are Invoices Facturas Nominativas

To write off any expenses, you must have invoices Nominal Invoices (this is often the name of those invoices where all the necessary data will be indicated). They must be issued in your name or the name of your business (with your NIE/NIF or CIF number). They must contain full information about the supplier of goods or services: company name, address, NIF number. Also mandatory fields are a description of the goods or service, date, amount, IVA amount (if any).

For example, you buy something at Mediamarkt for your work. At the checkout, ask in advance what you need. Nominal Invoice. Or if we use some online service (subscription, ChatGPT, Canva, Photoshop, etc.) or make a purchase online, such a full invoice can often be requested from their support or found in the buyer's account. Then we transfer this invoice to the store or upload it to the account in the section where expenses are indicated.

Private health insurance costs for the self-employed

Personally, I was pleased that the costs of private health insurance can be written off from income. This way, less tax is paid, and the overall price of insurance is cheaper. Why not use it if it really works. By the way, who will be interested in the topic "Private health insurance"then I can provide a contact where they speak Ukrainian, they will explain everything well and select insurance for you and your family." Contact us on the page Contacts or you can go to their website www.seguro.expert.

11. Real example of income, expenses, taxes and IVA\VAT payment for an Autónomo during a year in Spain

In this section, I will share the real numbers and all the details so that you can clearly see how much tax I had to pay.

I would like to point out right away that in most invoices for customers outside of Spain, IVA is indicated as 0, but there are also those where IVA \ VAT was still charged. These are customers or companies that are not tax payers in their country and in such cases we have to add VAT to the invoice and then return these funds to Spain.

The system for calculating the amount of IRPF, IVA, taking into account expenses and everything else is very complex and includes many subtleties. For example, there is such a thing as “Expenses that are difficult to justify” / “Gastos de difícil justificación”, and we are able to subtract additionally 5%-7% from our income to reduce the amount of tax. There are a lot of such nuances, so I recommend entrusting these issues to professionals (an accountant or a special service where all this will be taken into account).

I will show my real figures, the amounts of taxes and IVA paid.

I broke everything down into blocks:

1st quarter of 2024

| Invoice No. | Date | Country | Paid | IVA (21%) | Income |

| 1/2024 | 11.01.2024 | Czech Republic | 500 | 0 | 500 |

| 2/2024 | 15.01.2024 | Czech Republic | 875 | 0 | 875 |

| 3/2024 | 16.01.2024 | Spain | 121 | 22,29 | 98,71 |

| 4/2024 | 02.02.2024 | Czech Republic | 1100 | 0 | 1100 |

| 5/2024 | 05.02.2024 | Czech Republic | 100 | 0 | 100 |

| 6/2024 | 22.02.2024 | Great Britain | 500 | 0 | 500 |

| 7/2024 | 03.03.2024 | Great Britain | 930 | 0 | 930 |

| 8/2024 | 06.03.2024 | Czech Republic | 75 | 0 | 75 |

| 9/2024 | 15.03.2024 | Czech Republic | 1089 | 189 | 900 |

| 10/2024 | 22.03.2024 | Great Britain | 1000 | 0 | 1000 |

| 11/2024 | 23.03.2024 | Czech Republic | 600 | 104,13 | 495,87 |

Income excluding IVA: 6574.58 euros.

IVA received: 315.42 euros.

Costs:

- Social Security Contribution (Seguridad Social): 69.33 + 86.66 + 86.66 = 242.65 euros.

- Private health insurance: 2 months × 125.28 = 250.56 euros.

- Hestor: 3 months × 84.70 = 254.10 euros (of which IVA: 3 months × 14.70 = 44.10 euros).

- Video card (part for computer operation): 689.91 euros (of which IVA: 119.74 euros).

Total costs: 1273.38 euros.

IV:

- Received: 315.42 euros.

- Paid (returned to Spain): 166.28 euros.

- IVA balance: 315.42 – 166.28 = 149.14 euros (remaining).

IRPF paid: 1222.84 euros.

Net income for the 1st quarter:

6574.58 – 1273.38 – 1222.84 + 149.14 = 4227.50 euros.

2nd quarter of 2024

| Invoice No. | Date | Country | Paid | IVA (21%) | Income |

| 12/2024 | 26.04.2024 | Czech Republic | 653,4 | 113,4 | 540 |

| 13/2024 | 29.04.2024 | Spain | 45,6 | 8,4 | 37,2 |

| 14/2024 | 10.05.2024 | Great Britain | 160 | 0 | 160 |

| 15/2024 | 24.05.2024 | Czech Republic | 1210 | 210 | 1000 |

| 16/2024 | 12.06.2024 | Spain | 129,95 | 22,55 | 107,4 |

| 17/2024 | 26.06.2024 | Slovakia | 1401,18 | 243,18 | 1158 |

Income excluding IVA: 3,002.60 euros.

IVA received: 597.53 euros.

Costs:

- Social Security Contribution (Seguridad Social): 3 months × 86.66 = 259.98 euros.

- Private health insurance: 3 months × 125.28 = 375.84 euros.

- Hestor: 3 months × 84.70 = 254.10 euros (of which IVA: 3 months × 14.70 = 44.10 euros).

- Elementor (Professional Subscription): €371.24.

- Headphones: 225.99 euros (of which IVA: 39.22 euros).

- Printer: 139.98 euros (of which IVA: 24.29 euros).

Total costs: 1,519.52 euros.

IV:

- Received: 597.53 euros.

- Paid (returned to Spain): 179.52 euros.

- IVA balance: 597.53 – 179.52 = 418.01 euros (remaining).

IRPF paid: 489.92 euros.

Net income for the 2nd quarter:

3,002.60 – 1,519.52 – 489.92 + 418.01 = 1,411.17 euros.

Q3 2024

| Invoice No. | Date | Country | Paid | IVA (21%) | Income |

| 18/2024 | 04.07.2024 | Great Britain | 350 | 0 | 350 |

| 19/2024 | 01.08.2024 | Germany | 150 | 0 | 150 |

| 20/2024 | 10.08.2024 | Slovakia | 150,04 | 26,04 | 124 |

| 21/2024 | 26.08.2024 | Czech Republic | 1000 | 0 | 1000 |

| 22/2024 | 27.08.2024 | Spain | 77,36 | 14,25 | 63,11 |

| 23/2024 | 05.09.2024 | Spain | 122,21 | 22,51 | 99,7 |

| 24/2024 | 30.09.2024 | Great Britain | 80 | 0 | 80 |

Income excluding IVA: 1866.81 euros.

IVA received: 62.80 euros.

Costs:

- Social Security Contribution (Seguridad Social): 3 months × 86.66 = 259.98 euros.

- Private health insurance: 3 months × 125.28 = 375.84 euros.

- Hestor: 3 months × 84.70 = 254.10 euros (of which IVA: 3 months × 14.70 = 44.10 euros).

- Work phone: €304.57 (of which IVA: €52.86).

- Tablet for work: 107.91 euros (of which IVA: 18.73 euros).

Total costs: 1186.71 euros.

IV:

- Received: 62.80 euros.

- Paid (returned to Spain): 0 euros.

- IVA balance: 62.80 – 0 = 62.80 euros (remaining).

IRPF paid: 15.74 euros.

Net income for the 3rd quarter:

1,866.81 – 1,186.71 – 15.74 + 62.80 = 727.16 euros.

Q4 2024

| Invoice No. | Date | Country | Paid | IVA (21%) | Income |

| 25/2024 | 01.10.2024 | Czech Republic | 75 | 0 | 75 |

| 26/2024 | 22.10.2024 | Ukraine | 580,51 | 0 | 580,51 |

| 27/2024 | 01.11.2024 | Ukraine | 169,06 | 0 | 169,06 |

| 28/2024 | 01.11.2024 | Ukraine | 79,08 | 0 | 79,08 |

| 29/2024 | 04.11.2024 | Ukraine | 72,31 | 0 | 72,31 |

| 30/2024 | 04.11.2024 | Ukraine | 96,5 | 0 | 96,5 |

| 31/2024 | 06.11.2024 | Ukraine | 48,12 | 0 | 48,12 |

| 32/2024 | 14.11.2024 | Portugal | 3000 | 0 | 3000 |

| 33/2024 | 08.11.2024 | Ukraine | 290 | 0 | 290 |

| 35/2024 | 06.11.2024 | Ukraine | 180,67 | 0 | 180,67 |

| 36/2024 | 16.11.2024 | Ukraine | 193,25 | 0 | 193,25 |

| 37/2024 | 16.11.2024 | Ukraine | 96,5 | 0 | 96,5 |

| 38/2024 | 17.11.2024 | Ukraine | 638,3 | 0 | 638,3 |

| 39/2024 | 18.11.2024 | Ukraine | 144,87 | 0 | 144,87 |

| 40/2024 | 20.11.2024 | Ukraine | 81,99 | 0 | 81,99 |

| 41/2024 | 21.11.2024 | Ukraine | 483,5 | 0 | 483,5 |

| 42/2024 | 26.11.2024 | Ukraine | 599,6 | 0 | 599,6 |

| 43/2024 | 29.11.2024 | Ukraine | 822,12 | 0 | 822,12 |

| 44/2024 | 04.12.2024 | Czech Republic | 75 | 0 | 75 |

| 45/2024 | 09.12.2024 | Czech Republic | 300 | 0 | 300 |

| 46/2024 | 16.12.2024 | Ukraine | 604,44 | 0 | 604,44 |

| 47/2024 | 19.12.2024 | Ukraine | 386,75 | 0 | 386,75 |

| 48/2024 | 19.12.2024 | Ukraine | 386,75 | 0 | 386,75 |

| 49/2024 | 19.12.2024 | Ukraine | 413,84 | 0 | 413,84 |

| 50/2024 | 19.12.2024 | Great Britain | 530 | 0 | 530 |

| 51/2024 | 21.12.2024 | Cyprus | 78,77 | 0 | 78,77 |

| 52/2024 | 23.12.2024 | Ukraine | 967,25 | 0 | 967,25 |

| 53/2024 | 26.12.2024 | Ukraine | 677 | 0 | 677 |

| 54/2024 | 26.12.2024 | Ukraine | 290 | 0 | 290 |

| 55/2024 | 27.12.2024 | Ukraine | 967,25 | 0 | 967,25 |

| 56/2024 | 27.12.2024 | Portugal | 2990 | 0 | 2990 |

| 57/2024 | 28.12.2024 | USA | 210 | 0 | 210 |

| 58/2024 | 29.12.2024 | Czech Republic | 660 | 0 | 660 |

| 59/2024 | 31.12.2024 | Spain | 2420 | 420 | 2000 |

Income excluding IVA: 19188.43 euros.

IVA received: 420 euros.

Costs:

- Social Security Contribution (Seguridad Social): 3 months × 86.66 = 259.98 euros.

- Private health insurance: 3 months × 125.28 = 375.84 euros.

- Hestor: 3 months × 84.70 = 254.10 euros (of which IVA: 3 months × 14.70 = 44.10 euros).

Total costs: 845.82 euros.

IV:

- Received: 420 euros.

- Paid (returned to Spain): 341.74 euros.

- IVA balance: 78.26.

IRPF paid: 2978.85 euros.

Net income for the 4th quarter:

19188.43 – 845.82 – 2978.85 + 78.26 = 15442.02 euros.

Totals for the year (before filing the annual return)

The income for the year was 30,632.42 euros (excluding expenses and IVA), and advance payments of IRPF tax (model 130) amounted to 4,707.35 euros. We can say that at the moment the tax amounted to 15.37%. This amount is calculated based on the net income for each quarter, taking into account expenses.

However, this is not the final amount of tax paid, since when filing the annual declaration (Income Tax Declaration) will be recalculated:

- The declaration will take into account all expenses that reduce taxable income (I wrote about this in point 10).

- The tax office will also calculate the real tax rate, which is determined by a progressive scale depending on income (described in here).

After submitting the annual tax return, I will describe everything in detail here in the article.

Summary of service payments for the year:

Social Security (Seguridad Social): 1,022.61 euros.

Private health insurance (family of 3): 1,252.80 euros.

Hestor: 1,016.40 euros (of which IVA: 176.40 euros).

12. IRPF (Income) Return: Year-end Results

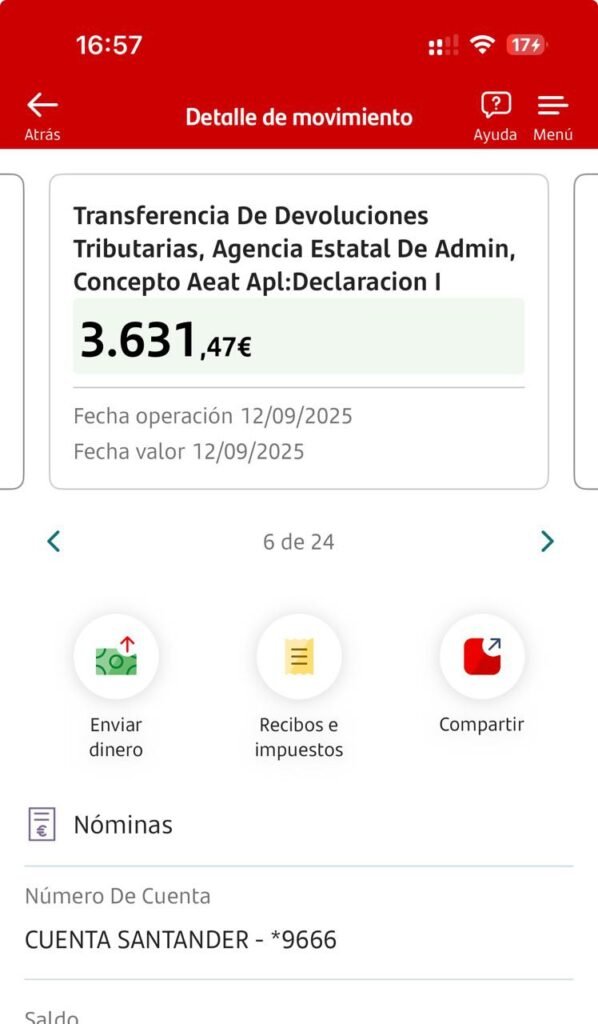

My wife filed her annual tax return and called to congratulate me: "Until the return of 3631 €". At first I didn't believe it, but later I realized that the state would really charge this amount to my account. This was possible thanks to the correct filing of the declaration: expenses, family and other deductions, as well as a progressive scale were taken into account. I am convinced that this is exactly quality hestor in such matters, a lot decides. I have already received the money:

Totals for the year (after filing and returning Renta)

- Total income for the year: 30632 €

- IRPF advance payments during the year (modelo 130): 4707 €

- Return based on the results of the annual declaration: 3631 €

- Actual IRPF paid for the year: 1076 €

- Effective IRPF rate: 3.51 %

So my real income tax in Spain for the year was only 3.51 %For me, this is a very good result.

13. Thank you for reading to the end.

I am sincerely grateful to everyone who took the time to read this extensive article. I wish everyone an easy time running a freelance business and developing their business in Spain. I hope this article was useful to you and helped you understand the topic a little.

This is just the beginning. There are more articles and instructions ahead that will be useful to everyone. Materials about:

- Hestor for autonomous workers in Spain: what it does and why it is needed.

- Private or public healthcare in Spain? Important differences and tips for choosingLet me remind you that private health insurance in Spain can be deducted from income and thus reduce the tax burden.

A big guide will be released soon obtaining a mortgage in SpainFor me, opening an autonomous business was the first step on this path. And I can say that we have already received a mortgage - so we have enough experience and details.

Join our Telegram channel to always stay up to date with new articles and useful materials about life in Spain. https://t.me/ucranianos_uno

And I invite you to chat – https://t.me/ucranianos_uno_chat. There we will discuss topics from articles and share experiences. Also, in the future, separate branches will be created for the convenience of discussion: autonomous, medicine, mortgage, customs clearance and others.

There's a lot of interesting things ahead, so stay tuned - it'll be useful!