After reading many messages and warnings in public forums that "preferential customs clearance in Spain for Ukrainians is only 1 year", "you can only drive for 213 days from the date of receiving temporary protection", we decided to put our car on Spanish license plates. We want to share our own experience, since not everything was always clear from the instructions that are now being distributed on Telegram and other social networks.

Join our Telegram channel to not miss new useful posts and articles about Spain – https://t.me/ucranianos_uno.

Our car is a Scoda Octavia A7, 2014, 1.6 TDI. Perhaps for those who have an “American” car, there will be some difficulties in completing some stages, but their list and sequence will most likely remain the same.

First you need to know what is several conditions, under which a Ukrainian can now “clear a car in Spain with benefits” (exemption from paying many taxes, which is about 45% of the cost of the car):

- The person has already received a TIE card (Tarjeta de Identidad de Extranjero - the main document certifying the identity of a foreigner resident in Spain);

- The person receiving “customs clearance benefits” must have been the legal owner of the vehicle for at least six months prior to the date of receipt of the TIE;

- The person has a registration document (empadronamiento) at the place of residence in Spain. Before starting all the customs clearance steps, you must update your empadronamiento extract, as it is only valid for 3 months. This can be done in 10-20 minutes at OMAC.

Step 1. Registration of DUA (customs declaration)

This step is done online. Physical presence of the vehicle or going to customs to register a DUA is not required!

ATTENTION! The maximum period that can elapse between receiving the Documento Único Administrativo (DUA) and submitting the complete package of completed documents to the Jefatura Provincial de Tráfico is 60 days.

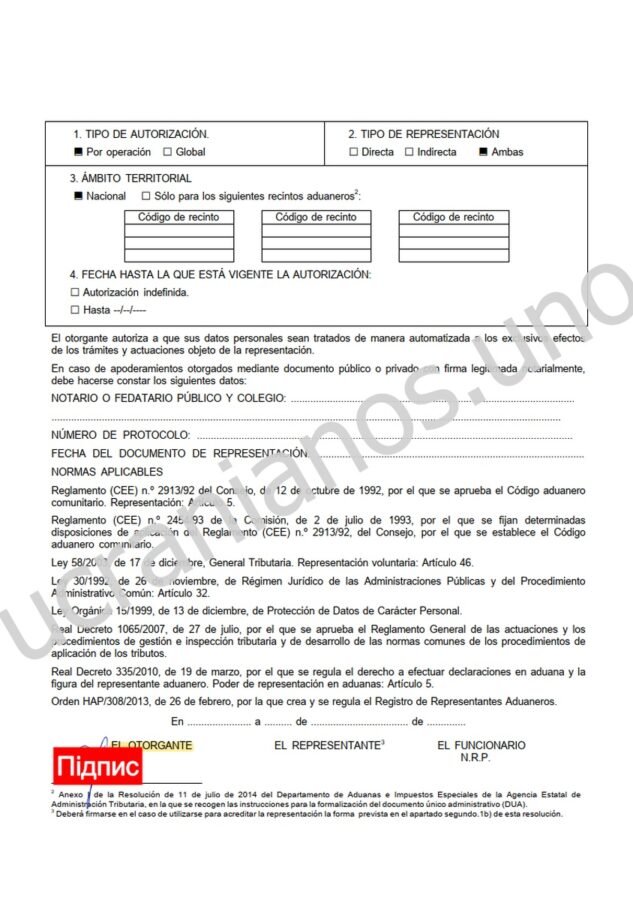

I looked through a lot of messages where people share different information about customs clearance. I realized that for this step you need to find a company (brokerage office) and write them a letter directly to their email that you need to apply for a DUA. I found several options on Google. I immediately asked everyone about the prices. Some simply haven't replied to me yet (they're Spaniards), and some wrote that their work is 100-250 euros + payment of the fee for the car (4600+ euros for our car, it turned out approximately). I understood that they don't know these rules about "preferential customs clearance" or I didn't fully explain everything to them. And then a few more people who had already passed this stage sent me a recommendation for a Spanish company Gecotex which deals with the registration of DUA. I also recommend this company. They are already familiar with all the intricacies, quickly wrote back to me and explained what is needed to register a DUA.

1. We write to them in feedback form on their websiteHere is the link to the form https://gecotex.es/importar-coche-ucraniano-espana-dua/

2. We send photos/scanned copies to their email:

- vehicle registration certificate (Ukrainian)

- NIE (white A4 sheet)

- TIE (plastic card)

- Empadronamiento – document of registration at the place of residence in Spain

- 4 photos of the car (front, back, both sides)

- photos of 4 completed and signed documents that they will send by email (you can print them, fill them out and then scan them or take a photo with your phone). After filling out the documents, everything is simple:

- D/D.ª, The one who subscribes, D – first and last name;

- DNI/Pasaporte nº, con DNI / NIE, NIF – NIE number;

- with domicile, municipality – city of residence;

- public road – street;

- No. – house number;

- Fdo. – signature.

3. Then they issue a bill (we had this 302 euros), which must be paid at the bank counter or in the app of your Spanish bank. The payment receipt should then be sent to their email).

Someone was paying them 242 euros, but from September 1, mandatory payment was introduced Fluorinated Gases – 60 euros.

4. After paying the bill within 1 day, they will send you a DUA by email.

Step 2. Registration of FTR (reduced technical data sheet)

This step also takes place online.

Companies for design Reduced technical data sheet, as was the case with DUA, there are also many. I will recommend the one I used to apply. To get a link to the site click here.

1. Go to their website:

- Select the menu item “Pídala Aqui” and fill out the form;

- In the “Budget recipient” item, select the first option from the list that appears “I am a foreign citizen, I am coming to live in Spain and I want to register my vehicle”;

- Click on REQUEST REDUCED FORM to send the form.

2. After sending the form, the company manager will write to your specified email and provide a list of documents that need to be sent to them in the form of a photo/scan copy, as well as a list of photos of the car:

- technical passport, NIE (white A4 sheet), TIE (plastic card);

- photo of the vehicle manufacturer's license plate. Riveted on

in the engine compartment or on the side sills (I looked for this for a long time and found it on the right door somewhere below); - photo of the car (front, back, both sides);

- a photo of the tires currently installed on the vehicle (to show the size and load and speed ratings). If the front and back sides are different, a photo of each tire;

- photo of the tire size plate, if available.

They also say that you need to ask to be indicated vehicle emissions standard not lower than EURO5I wrote to them about it and they said it was ok.

The price of the FTR registration will be indicated right in the list of required documents and photos. In our case, it was 49.95 euros.

3. Then, when they have all the photos and documents, they will send you payment details, and here it turns out 49.95 + commission = 60.44 euros.

We pay at the bank counter or the app of our Spanish bank (then send the receipt to their email).

4. After paying the bill within 1 day, they will send you the FTR by email.

Attention! The PDF files they will send to you by email are digitally signed. You need to not only print them for the next step, but also save them to a USB stick or somewhere so you can send them by email. That's exactly what I was asked to do when I signed up for ITV.

Step 3. Passing the ITV (technical inspection)

Attention! This step is offline. You need physical presence of the car to pass the ITV - technical inspection. You also already have the first two steps must be completed.

1. We take a net (record) for passing ITV.

We search directly on Google Maps or another ITV map for services that are near you. It won't work to get a net online, since when filling in the data you need to enter the Spanish car number, and we don’t have it at this stage yet. Just in case, I’m posting a link where you can get the net online – https://aibs.appluscorp.com/Mobile/.

I went to the nearest ITV service to me (Elche). They welcomed me with joy and understood that I was clearing a car. I provided all the necessary documents (DUA, FTR, vehicle registration, TIE, NIE, registration). They also asked me to provide original FTR file with digital signature, which was sent to me when I applied for the FTR. I sent it directly from my phone to their email (they showed me which one).

2. Payment of ITV.

After making all the copies and entering them into the database, they asked me to pay the bill. I paid in cash on the spot. It worked out. 110.86 euros.

They didn't give me an appointment right away, but said they would call me back the next day. And so it was. They called me back and scheduled an appointment in 4 days. In my basic Spanish, I was able to understand the day and time without any problems.

3. ITV Pass Day

I showed up half an hour before the appointed time. They told me to wait. Then an employee came up and showed me where I needed to go with my car. There were several lines and a fairly long queue. He let me through without waiting in line in front of everyone else.

And here begins a complete check of the car: from the signal and headlights to computer diagnostics for errors. Even the size of the car was measured with a tape measure. I recommend that you bring the car into full working order so that there are no problems when passing the ITV technical inspection.

Everything took about 1 hour. The employee took the Ukrainian technical passport, and then gave out a piece of paper (temporary) and a sticker. He told me to come back in 3-6 days for the originals and warned me that To receive the original ITV, the person in whose name all documents are issued must come..

4. Obtaining ITV originals

They came in 6 days, as the ITV employee said. They showed us a piece of paper (temporary ITV) that they had issued before. And they gave us 3 identical pieces of paper with a wet seal and signatures. The pieces of paper have all the car's data on them. As I understand it, these are the original ITVs. They are needed for the next steps of customs clearance.

Step 4. Payment of Impuesto de Circulación: IVTM (payment of car tax)

This, as I understand it, is the annual payment for a car (car tax in Spain).

As I was told in the comments (thanks Serhiy), it can be called differently in different provinces. It is also known as Impuesto sobre Vehículos de Tracción Mecánica (IVTM). More details here.

At the time of customs clearance of the car we were living in Elche, Alicante. I found information somewhere that we needed to find an office like Suma, and that's where we should go to pay this tax. But from there we were directed to the Ayuntamiento (or OMAC, which I understand is not available everywhere).

Ago for this step you need to go to the Ayuntamiento where you live and ask them about paying this annual car tax (IVTM).

We were given a queue number, waited a little while and approached the employee. We also explained to her that we wanted to pay the annual car tax. She asked for documents, entered something into the database, and printed out an A4 sheet of paper with contact details, NIE, car details and at the bottom the amount that needs to be paid (this is the balance until the end of the year) – 16.08 euros.

On the same piece of paper at the very bottom there is a list of banks where this bill can be paid (SABADELL, CAJAMAR, etc.). We went to the nearest SABADELL to pay, but they said that payment is only on Tuesdays and Thursdays from 09:00 to 11:00. Maybe those who are clients of these banks would be able to pay at any time. But we are clients of Santander Bank. We went there just in case, and Santander told us that we would not be able to pay there, since there is no connection with this database. Therefore, you need to contact only the banks on the list and pay this receipt at the appropriate time.

I think it all depends on the city and province where you are in Spain.

Step 5. Agencia Tributaria (tax, obtaining Modelo 06)

I've seen a lot of different opinions, misunderstandings, and worries about this Modelo 06. “What is Modelo 06?”, “Who has already made a Modelo 06?”, “I need a hestor for Modelo 06,” “I need to prove to the tax office the reason for not paying something there,” and many other things are written in Telegram publics.

I decided to go to this Agencia Tributaria by myself without a translator or anyone else and see if everything was so scary there. It turned out that everything was simple, although we had been to the Agencia Tributaria twice.

We take an appointment (appointment) at the Agencia Tributaria:

- Go to the site sede.agenciatributaria.gob.es and press “Previous quote”.

- We select the item "Solicitud de cita previa para particulares".

- We choose “The appointment is for me”. Enter NIE, First name and last name. Next (Siguiente)

- We choose “Other management”, further “More management”, further “Taxes and Fees” and select the item "Vehicle Registration (IEDMT)". Next (Siguiente)

- Then in the pop-up window, select the province. Confirm (Aceptar).

- And now in the list of available Agencia Tributaria we look for the city that suits you, select the date and time and click Seleccionar (select). Then we confirm the selection by clicking “Confirm appointment”.

- And the last point. Here we indicate the Phone number, Email (optional) and click “Confirm”.

- Done, record (sieve) in Tax Agency done.

On the appointed day and time, arrive for an appointment at the tax office (Tax Agency). At the entrance we went through a metal detector, said our name and surname and were given a number. Using this number we approached the appropriate table.

IMPORTANTLY! You need to bring all documents to the tax office in printed form (make photocopies). Namely:

1. PRAYER

2. FTR

3. ITV

4. Ukrainian technical passport for a car

5. NIE (white A4 sheet) and TIE (plastic card)

6. Registration (empadronamiento)

+ I THINK A VERY IMPORTANT POINT – must be brought already printed document with data for Modelo 06which is done on the same site Tax Agency. It was because of the lack of this document (printed form) that we went here 2 times. Also, the first time we were at the tax office, we were told to change the place of registration in the database, since we changed our residence address after receiving the TIE (the old residence address is indicated on the plastic card). You don't need to change the TIE or go anywhere for this. The manager simply redirected us to his colleague, told us the table number, and we changed this address in 3 minutes. I understand it is stored somewhere in their database.

Also, the manager at the tax office explained step by step how to fill out this form yourself, like Model 06 on their website, which we then bring here with all copies of documents and receive Form Modelo 06 with the code that is needed for the next step – DGT. He explained it all in 2 minutes on his computer. I had seen before that there were cases where employees immediately filled out and printed this form for Ukrainians without having to come again. But he asked us to do it ourselves and come again with everything we needed.

Instructions on how to complete the Modelo 06 form on the Agencia Tributaria website:

- Go to the site sede.agenciatributaria.gob.es

- In the search on the site, enter “Modelo 06”

- Then we select the first item, which is called “Modelo 06”

- In the Help section, click on “Modelo 06”

- Next, select the item “Modelo 06. Draft declaration”

- And in the next step we start filling in the data. I filled everything in from memory, as the manager at the tax office showed me:

- Exercise – 2022 (I understand that the current year is automatically substituted here)

- Characteristics of the transport medium – Used

- Type of means of transport – Automobiles

- Next, click “Send”

- Taxpayer

- NIF -your NIE number

- Surnames and Nombre o Social Reason – first and last name

- Characteristics of the transport medium

- We choose Acquired in a State that is not a member of the European Union

- Date of entry into service – date from the ITV booklet, item Observacions, sub-item Fecha primera marticulacion. As I understand it, this is the date when the car was registered.

- Kilometers of use – car mileage. Taken from the first (temporary) ITV from the Lectura cuentakilometros point.

- Then enter again NIF (NIE) and Surname and First Name (Name and surname) of the person who imported the vehicle into Spain

- Vehicles

- March – car brand (ITV, point D.1)

- Model-Type – car brand (ITV, point D.2)

- Observations – the first item Resto de vehículos (Rest of vehicles)

- Número de identificación (bastidor) – vehicle identification number or VIN number (ITV, item E)

- ITV Code – the ITV code (like the service center number) where you went through it. This code can be seen on the seal on the original ITV. In my case, it was 4 digits 0305.

- ITV card serial number – your ITV document number, item Número de serie. Many numbers starting with 0305 (ITV code), etc.

- Next to the ITV card number, select a letter from the drop-down list. This letter is printed in bold and large font on the original ITV next to the ITV number. In my case, it was the letter A.

- Then we choose Gasoline engine (gasoline) or Diesel Engine (diesel)

- Displacement (cc) – cylinder volume (ITV, item P.1, cilindrada). In my case it was 1.598.

- Classification – vehicle classification (ITV, point CL). I think for all passenger cars it will be 1000 Turismo nacional / importation.

- Classification (70/156/EEC) – I missed this.

- CO Emissions2 (g/Km.) – also missed

- Declaration

- Here we select the item (B) Exento (released)

- Then in the drop-down list Clave we select an item ET4 (this is important, explained in the tax office).

- Taxable base – price taken from DUA (Statistical value or item price)

- Next, submit the form by clicking Send.

- And on the next page you will see all the entered data in the table. I am attaching an example:

Importantly! This page needs to be printed (directly in the browser Page > Print, Settings > Print) or saved as a PDF file and then printed somewhere else (Print > Destination - Save as PDF).

And now, with this printed form and all the necessary copies of documents, you need to come to the Agencia Tributaria.

At the reception, when we came with all these documents, it took 10 minutes. The employee took all the copies of the documents and at the end gave us a printed sheet (form) Modelo 06 with filled code Electronic code, which is important for the next step – DGT.

Step 6. DGT (direccion general de traffico)

At this stage you need take a net at DGT and bring all documents from the previous steps to the meeting in printed form (photocopies) and originals: DUA, FTR, ITV, payment of Impuesto de Circulación (SUMA), modelo 06 (with code) and also Ukrainian technical passport, TIE. The DGT also asked us for one filled-in sheet, which we did not know about. It is called TRÁMITES DE VÉHÍCULOS. We did not have it, and we were told that it was not a problem. They printed it on the spot and told us how to fill it out. But I think it is better to come with a printed one. This document can be downloaded from the DGT website (enter modelo Mod.01-ES.pdf in the search) and printed. I think it is better to fill it out already at the DGT, since they will tell you what and where to write. But the data there is basically the same as in the previous points.

We take a screen (appointment) at the DGT:

- Go to the site https://sede.dgt.gob.es/es/otros-tramites/cita-previa/

- Select an item Request for prior appointment

- IN Oficina donde desea solicitar la cita – choose a city

- Type of procedure – select Office procedures

- At the next stage in the line Vehicle registration press Continue

- Next, we enter NO, Email (email)) and other contact details (optional) and click Request

- The next step will show you the nearest dates available for recording. Select the date, time and click Continue.

- Done, the sieve (record) in DGT is done.

On the appointed day and time, it is better to come to the DGT a little earlier (about 15 minutes). At the entrance, we were explained that we need to take a queue number. At the entrance, there was a machine where you enter the NIE, which was indicated when you registered, and if there are less than 15 minutes left until the registration, the machine will print a number. Already using this number, when it appears on the scoreboard, we approach the DGT employee.

The employee took all the copies and originals of the documents from us. As I already wrote, we were missing one sheet of TRÁMITES DE VÉHÍCULOS. But he printed it out himself and we immediately filled everything out on the spot. 20 minutes after entering all the data, the employee asked to pay. Payment only by card, immediately to him. The cost of DGT services is 99.77 euros.

After all this, they returned the original documents to us, only taking away the Ukrainian technical passport of the car. I asked if we could keep it (just in case), but the DGT employee laughed and made us a copy of the technical passport on an A4 sheet of paper for a souvenir. We were also given a Spanish technical passport for the car. This is a regular paper book, which already has the Spanish car number written in it (which still needs to be made) and all the data. Interestingly, our car became 5 years younger, since they took the date of registration of the car when it was re-registered in Ukraine from European numbers. It was in 2014, it became 2019.

Step 7. Making Spanish numbers

I think that near every DGT or somewhere nearby you can find a printing house where they make numbers for cars. In a small printing house opposite the DGT, where we registered the car, they asked us for a technical passport Spanish and NIE. They showed examples of materials from which they can make numbers. Aluminum (like we have in Ukraine) price 28 euros, plastic (like almost everyone here in Spain) – 35 euros. They explained that aluminum ones will wear out faster when the car in the parking lot is “accidentally touched” by skilled drivers, as this is very common and normal here. But they took aluminum ones, such as the Ukrainian ones were before. I thought the process of printing the numbers could take several days, but it turned out – 5 minutes.

At this stage, everything is ready, but not quite. The last item left is insurance.

Step 8. Car insurance in Spain

I asked people in public forums “how and where they got car insurance in Spain”. Many wrote that the price was 400-500 euros minimum. I tried to calculate the price myself on the website of the insurance company MAPFRE, and their calculator gave me 960 euros. And this is the minimum insurance with the minimum number of insured events.

But there is a wonderful girl who speaks Ukrainian and will help you get car insurance in Spain without any problems. She will explain everything, select and do it as needed. Everything is done online and you don't need to go anywhere. And very often they ask, "I have Ukrainian license plates and Spanish license plates. Will it be possible to get car insurance in Spain with Ukrainian license plates?" The answer is yes.

My price was 337 euros. Send a request on the page Contact us and I will share contact information, or write to me at mail@Ukrainians.uno. They deal with car, home, life, and health insurance. By the way, I also wrote a separate article about health insurance in Spain. right hereIn my opinion, this is a very important and necessary thing in Spain and Europe in general.

Done. Let's sum up.

- DUA – 302 euros

- FTR – 60.44 euros

- ITV – 110.86 euros

- Tax – 16.08 euros

- DGT – 99.77 euros

The total cost of customs clearance of our car in Spain is 589.15 euros.

+ car insurance – 337 euros